Why PBGC Recalculated UAL Pension Benefits

When United Airlines went bankrupt, we became responsible for four of their pension plans. When this happened, we could not just accept UAL’s benefit, but had to do separate calculations using the rules in federal pension law. More than a year ago, we found out that one of those calculations (relating to how much the plans’ investments and other assets were worth when we took responsibility) was done badly. Since then, we have gone back and revalued the UAL plan assets, and found that we had undervalued the UAL pension assets slightly (by about half of one percent to one percent, depending on the plan).

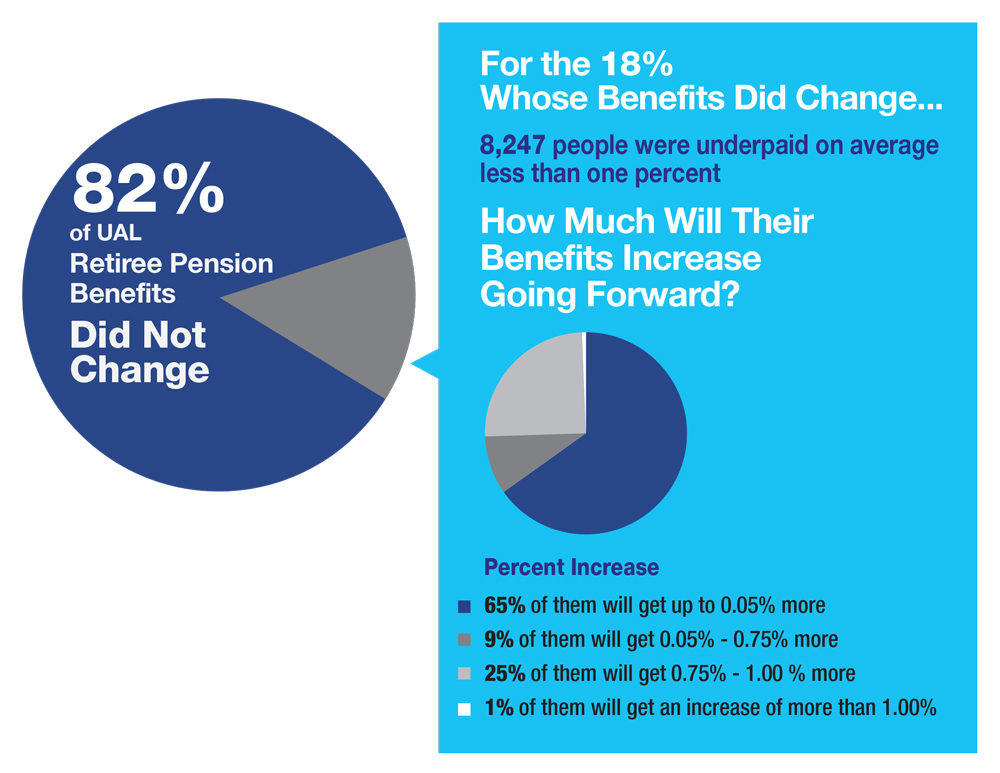

This recalculation had no effect on most people’s benefits, but some people’s benefits will be raised slightly, generally by less than one percent.

Because most people are already getting, or will get, the full amount of the pension they were promised by UAL. This change affects only those people whose pensions were more than the amount that PBGC guarantees.

People with benefits greater than we guarantee can still get more than the guaranteed amount, but how much more depends on how underfunded the plan is when we take it over. In those cases, the values of a plan’s assets and obligations (“liabilities”) affect benefits, so if we value those incorrectly, we’re not providing the right benefit.

In the case of the UAL plans, we slightly undervalued the plans’ assets at first. Now that we’ve re-done the work, some of the people whose UAL pensions were more than the PBGC maximums will get slightly greater benefits.

When Congress established PBGC, they set legal limits on the benefits we can normally pay. Some people’s pensions are above those limits.

But when people’s benefits are more than we guarantee, we use the assets we inherit from the plan to make up some of the difference. This helps some people in some plans, but is rarely enough to cover everyone’s full pension.

Most people were not affected by PBGC’s mistake and will see no change at all. For the less than one in five retirees who were affected:

- Pilots will get an average increase of about three-quarters of one percent.

- Participants in the management and administration plan will get an average increase of about two-thirds of one percent.

- Flight attendants will get an average increase of three one-hundredths of a percent.

- Participants in the ground employee plan will get an average increase of two one-hundredths of a percent.

We hired an internationally recognized certified public accounting firm experienced in pension plan assets to revalue each UAL asset. (The initial work had been done by a non-accounting firm). We then conducted our own reviews of the new asset valuations. After all that, we found only a small number of changes — changes whose effect was itself less than 1 percent for most of the people affected. From this we concluded that further delay and further work made no sense, that further work was unlikely materially to change the result — but it would delay a reckoning for months or years and further undermine the security of the people we serve.

The original contractor is no longer doing this work for us. We are going over the other plans that the contractor worked on to look for any other substandard work that might have led to underpayments. In those cases, we’re redoing the valuations and correcting benefits for those who were underpaid.

To prevent these mistakes from happening in other plans in the future, we are:

- Completely reforming our asset valuation process.

- Changing the people within PBGC who are responsible. We’re hiring specialists in asset valuation, and making those specialists responsible for this work.

- Using certified public accounting firms when we contract for this work, instead of general government contractors.

At first, PBGC vigorously resisted taking responsibility for UAL’s plans. It’s always best for pension plan participants if the company itself keeps the promises it makes.

But as UAL’s finances worsened — particularly as the price of fuel rose — it became clear that UAL could only survive bankruptcy if the pension plans were terminated. Given all the circumstances, we concluded that we had to take over the plans.

-

No. Based on the agreement approved by the bankruptcy court, we cannot force UAL to take back the pension plans. See Why PBGC Cannot Restore the United Airlines’ Pension Plans.

Most People’s Benefit Didn’t Change — How You’ll Know If Your Benefit Will Increase

Most people were not affected by PBGC’s mistake. If your benefit will increase, we will send you a letter explaining how your benefit will change. Most retirees whose benefits increase by more than five dollars per month should get a letter in August; most of the others, generally with smaller increases, will be notified in the next several months. People with benefits subject to qualified domestic relations orders, and other special cases which require more complex calculations, will take longer.

Not necessarily. We have begun sending out letters, but will do so in stages. First we’re correcting the biggest underpayments to people who are already retired. We expect to notify everyone affected by the end of this fall, except for people with qualified domestic relations orders and other special cases that require more complex calculations. You can find out more about our progress on the home page for your specific pension plan.

On August 15, 2012, we began mailing letters to pilots whose benefits will increase. By this fall, we expect to have mailed letters to everybody with an increased benefit, except for people with benefits subject to qualified domestic relations orders and other special cases that require more complex calculations.

Please check your plan’s web page on PBGC.gov for current mailing status.

About Changes to Your Benefit

For virtually everyone, the increase is less than one percent. There are a handful of people for whom the increase is between one percent and two percent. The reason is that the original asset valuations turned out to be more than 99 percent correct; although the original valuation was done badly, the impact of the bad work was comparatively minor.

We will adjust benefits to the new amounts over the next few months. The letter we send you will tell you when your benefit will change.

Yes. If you have already retired and have been underpaid, we will send you a back payment to account for the total amount that we underpaid you plus interest.

In most cases, we’ll include the back payment at the same time you get your corrected benefit payment. In a few cases, the back payment will follow the changed benefit. The letter we send you will tell you when we will send your back payment.

If the back payment is smaller than the amount you owe PBGC, it will be applied to what you owe. It will reduce the amount you owe us, so your benefit payments will be slightly greater.

Everyone whose benefit is changed will see a slight increase, not a reduction. In your case, we had already reduced your payment because at first, we continued the payments you were receiving from UAL and we paid you more than we’re allowed to pay. Now that we have re-done the calculations, you are still repaying an overpayment, but it is less than it was before, so your monthly benefit will be slightly higher.

Call us, and we’ll send you a benefit statement that shows the information we used to calculate your benefit and how we arrived at your final benefit amount. Benefit statements will be available beginning September 15.

If your monthly benefit increases by five dollars or more, we will send you a revised benefit determination, and you will have the right to appeal that benefit determination. If your benefit increases by less than five dollars, we will send you a letter telling you about the change; however, there is no appeal right for changes that are less than five dollars.

If you think you might want to appeal your benefit determination, but you need more information to decide, call us, and we’ll send you a benefit statement that shows how we arrived at your final benefit amount. But please be aware that you have 45 days from the date of your benefit determination letter to file an appeal. If you need more time, you can request an extension of the filing deadline from the Appeals Board. Your extension request must be in writing, and it must be received by the Appeals Board no later than 45 calendar days after the date of your benefit determination letter.